Ditch the nine-to-five grind and become your own boss! Buckle up for a rocket ride to the top as we explore the companies for network marketing experiencing phenomenal growth in 2025.

The MLM industry continues to grow, with thousands of companies worldwide shaping the future of direct selling. Whether you’re an entrepreneur exploring opportunities or an MLM enthusiast, knowing the top-performing MLM companies in 2025helps you understand where the industry is headed.

In this blog, we bring you a comprehensive list of the Top 100 MLM companies, ranked by annual revenue, growth rate, and global reach. Alongside, we’ll highlight success stories, emerging trends, and how these companies are redefining the industry.

From wellness warriors to tech titans, this list unveils the hottest opportunities to build your entrepreneurial empire (and maybe score some killer discounts along the way). So, grab your metaphorical jetpack and let’s blast off into the exciting world of MLM!

Global Reach: Many MLM companies are expanding into Asia, Africa, and South America.

Digital Transformation: Social media, e-commerce, and AI-driven MLM software make recruitment and sales easier.

Health & Wellness Boom: Nutrition, supplements, and essential oils dominate the market.

Flexible Income Source: People look for side hustles, making MLM attractive.

Discover which multi marketing companies are leading the charge in revenue, distributor recruitment, and market expansion, providing valuable insights for potential entrepreneurs and industry observers alike.

| # | Company | Country | Year Founded | Revenue 2024(in million USD) | Revenue 2023(in million USD) | Revenue 2022(in million USD) | Growth Rate |

| 1 | Amway | USA | 1959 | 7400 | 7700 | 8,100 | -4% |

| 2 | Natura & Co | Brazil | 1969 | 5649 | 4671 | 6,910 | 21% |

| 3 | Herbalife | USA | 1980 | 5000 | 5062 | 5,200 | -1% |

| 4 | eXp Realty | USA | 2009 | 4567 | 4300 | 4,600 | 6% |

| 5 | Vorwerk | Germany | 1883 | 4100 | 3450 | 4,100 | 19% |

| 6 | PM International | Luxembourg | 1993 | 3220 | 3030 | 3,200 | 6% |

| 7 | Primerica | USA | 1977 | 3089 | 2748 | 2,550 | 12% |

| 8 | Coway | South Korea | 1989 | 3031 | 2699 | 2,030 | 12% |

| 9 | Infinitus | China | 1992 | 3000 | 3500 | 2,900 | -14% |

| 10 | Utility Warehouse | UK | 2002 | 2590 | 2990 | 2,720 | -13% |

| 11 | Mary Kay | USA | 1963 | 2400 | 2500 | 2,400 | -4% |

| 12 | Melaleuca | USA | 1985 | 2200 | 2300 | 2,321 | -4% |

| 13 | Sunrun | USA | 2007 | 2037 | 2260 | 2,000 | -10% |

| 14 | Atomy | South Korea | 2009 | 1830 | 1710 | 2,230 | 7% |

| 15 | Young Living | USA | 1993 | 1800 | 2000 | 2,200 | -10% |

| 16 | Nu Skin | USA | 1984 | 1732 | 1969 | 1,800 | -12% |

| 17 | Forever Living Products | USA | 1978 | 1700 | 1800 | 1,750 | -6% |

| 18 | World Financial Group | USA | 2001 | 1500 | 1300 | 1,540 | 15% |

| 19 | DoTerra | USA | 2008 | 1450 | 1500 | 1,200 | -3% |

| 20 | JoyMain Int. | China | 2000 | 1300 | 1300 | 1,305 | 0% |

| 21 | REAL Brokerage | USA | 2014 | 1260 | 689 | 1,682 | 83% |

| 22 | Perfect China | China | 1994 | 1200 | 1250 | 1,300 | -4% |

| 23 | Sunhope | China | 1993 | 1100 | 1200 | 1,250 | -8% |

| 24 | Ambit Energy | USA | 2006 | 1030 | 1090 | 1,210 | -6% |

| 25 | Vivint Smart Home | USA | 1999 | 1000 | 790 | 1,200 | 27% |

| 26 | New Era Health | China | 1995 | 1000 | 1000 | 1,600 | 0% |

| 27 | O Boticario | Brazil | 1977 | 995 | 995 | 1,250 | 0% |

| 28 | Vida Divina | USA | 2016 | 917 | 917 | 1,000 | 0% |

| 29 | USANA | USA | 1992 | 855 | 921 | 995 | -7% |

| 30 | Longrich | China | 1986 | 850 | 850 | 803 | 0% |

| 31 | SeneGence | USA | 1999 | 800 | 900 | 999 | -11% |

| 32 | DXN Global | USA | 1993 | 800 | 902 | 902 | -11% |

| 33 | Belcorp | Peru | 1968 | 780 | 780 | 900 | 0% |

| 34 | Family First Life | USA | 2013 | 775 | 503 | 850 | 54% |

| 35 | Arbonne International | USA | 1975 | 700 | 700 | 989 | 0% |

| 36 | Betterware de Mexico | Mexico | 1995 | 689 | 768 | 800 | -10% |

| 37 | Oriflame | Sweden | 1967 | 653 | 811 | 780 | -19% |

| 38 | Quanjian | China | 2004 | 650 | 650 | 700 | 0% |

| 39 | C1 | UAE | 2019 | 625 | 625 | 700 | 0% |

| 40 | Optavia – Medifast | USA | 1981 | 602 | 1072 | 700 | -44% |

| 41 | Monat Global | USA | 2014 | 600 | 700 | 382 | -14% |

| 42 | Amore Pacific | South Korea | 1945 | 585 | 585 | 650 | 0% |

| 43 | Omnilife | Mexico | 1991 | 584 | 633 | 584 | -8% |

| 44 | LegalShield | USA | 1972 | 561 | 546 | 625 | 3% |

| 45 | LifeWave | USA | 2004 | 555 | 370 | 597 | 50% |

| 46 | RIMAN | South Korea | 2018 | 545 | 545 | 585 | 0% |

| 47 | QNet | Malaysia | 1998 | 520 | 520 | 759 | 0% |

| 48 | Market America | USA | 1992 | 500 | 800 | 508 | -38% |

| 49 | IYOVIA | USA | 2013 | 500 | 500 | 542 | 0% |

| 50 | ACN | USA | 1993 | 500 | 500 | 545 | 0% |

| 51 | Shaklee | USA | 1956 | 500 | 500 | 536 | 0% |

| 52 | Hy Cite Enterprises | USA | 1959 | 487 | 570 | 692 | -15% |

| 53 | Scentsy | USA | 2004 | 472 | 579 | 520 | -18% |

| 54 | Nature’s Sunshine | USA | 1972 | 454 | 445 | 500 | 2% |

| 55 | It Works! Global | USA | 2001 | 450 | 450 | 500 | 0% |

| 56 | Unicity | USA | 2001 | 450 | 450 | 450 | 0% |

| 57 | Yanbal International | Peru | 1967 | 450 | 500 | 446 | -10% |

| 58 | Chogan | Italy | 2013 | 450 | 342 | 300 | 32% |

| 59 | Golden Days China | China | 1991 | 446 | 446 | 500 | 0% |

| 60 | PHP Agency | USA | 2009 | 440 | 300 | 495 | 47% |

| 61 | Tiens | China | 1995 | 435 | 435 | 422 | 0% |

| 62 | Farmasi | Turkey | 2003 | 429 | 440 | 428 | -3% |

| 63 | Beach Body | USA | 1998 | 419 | 527 | 435 | -20% |

| 64 | Pola | Japan | 1929 | 411 | 433 | 434 | -5% |

| 65 | Isagenix | USA | 2002 | 400 | 400 | 548 | 0% |

| 66 | Lux International | Switzerland | 1901 | 396 | 396 | 410 | 0% |

| 67 | Juice Plus+ | USA | 1970 | 395 | 400 | 400 | -1% |

| 68 | LuLaRoe | USA | 2013 | 395 | 400 | 400 | -1% |

| 69 | Younique | USA | 2012 | 368 | 368 | 396 | 0% |

| 70 | Faberlic | Russia | 1997 | 368 | 346 | 495 | 6% |

| 71 | Miki Corp. | Japan | 1965 | 358 | 371 | 454 | -4% |

| 72 | Cosway | Malaysia | 1979 | 350 | 350 | 419 | 0% |

| 73 | Partner.co | USA | 2007 | 350 | 350 | 114 | 0% |

| 74 | Le-Vel | USA | 2012 | 350 | 350 | 320 | 0% |

| 75 | ModiCare | India | 1996 | 350 | 350 | 368 | 0% |

| 76 | Pure Romance | USA | 1993 | 350 | 350 | 368 | 0% |

| 77 | Premier Financial Alliance | USA | 2003 | 350 | 300 | 350 | 17% |

| 78 | Plexus Worldwide | USA | 2008 | 341 | 377 | 350 | -10% |

| 79 | Pruvit | USA | 2015 | 336 | 336 | 350 | 0% |

| 80 | Greenway Global | Czech Republic | 2017 | 326 | 307 | 350 | 6% |

| 81 | Princess House | USA | 1963 | 320 | 299 | 366 | 7% |

| 82 | LG Household & Health | South Korea | 1947 | 320 | 320 | 101 | 0% |

| 83 | LR Health & Beauty | Germany | 1985 | 303 | 296 | 341 | 2% |

| 84 | For Days Co. | Japan | 1997 | 301 | 301 | 340 | 0% |

| 85 | Pampered Chef | USA | 1980 | 300 | 300 | 507 | 0% |

| 86 | 4Life | USA | 1998 | 300 | 341 | 320 | -12% |

| 87 | Neora | USA | 2011 | 300 | 300 | 315 | 0% |

| 88 | Prowin international | Germany | 1995 | 283 | 283 | 320 | 0% |

| 89 | Siberian Health | Russia | 1996 | 280 | 280 | 285 | 0% |

| 90 | Betterway | Thailand | 1988 | 280 | 280 | 301 | 0% |

| 91 | New Image Group | New Zealand | 1984 | 261 | 434 | 300 | -40% |

| 92 | InCruises (InGroup) | USA | 2015 | 253 | 205 | 300 | 23% |

| 93 | New U Life | USA | 2017 | 250 | 250 | 200 | 0% |

| 94 | Just International | Switzerland | 1930 | 250 | 250 | 383 | 0% |

| 95 | Seacret Direct | USA | 2005 | 250 | 320 | 294 | -22% |

| 96 | Stella & Dot | USA | 2003 | 250 | 300 | 283 | -17% |

| 97 | Total Life Changes | USA | 2003 | 250 | 300 | 280 | -17% |

| 98 | Noevir | Japan | 1964 | 245 | 245 | 265 | 0% |

| 99 | Alliance In Motion | Philippines | 2005 | 238 | 238 | 315 | 0% |

| 100 | Sunrider International | USA | 1982 | 236 | 236 | 250 | 0% |

Data Source : BusinessForHome, Direct Selling News, and WFDSA

📊 Notice how companies focusing on health, sustainability, and digital real estate are outperforming traditional MLMs.

Wellness Nutrition: This sector consistently ranks high in MLM due to the ever-growing focus on healthy living. companies for network marketing like Natura & Co, a Brazilian giant focused on sustainable and natural beauty and personal care products, have witnessed impressive growth. Similarly, established names like Herbalife continue to expand their reach with targeted nutritional solutions. Even newer entrants in multi marketing companies like DoTerra, with their essential oil-based products, are making waves with a loyal customer base.

Tech-Enabled Network Marketing: The digital age has transformed how companies for network marketing operate. eXp Realty, a fast-growing real estate brokerage leveraging a cloud-based platform, exemplifies this trend. They empower agents through online tools and commission structures, attracting talent and driving growth. Established companies for network marketing are also adapting. Amway, a long-standing leader in multi marketing companies industry, has embraced digital tools to enhance distributor communication and product sales.

Emerging Markets: The Asia-Pacific region is a hotbed for MLM growth. chain marketing company like Young Living, with their essential oils and personal care products, have seen significant expansion in China and Southeast Asia.

Infinitus, a Chinese chain marketing company focused on traditional Chinese medicine, is another major player. These chain marketing company cater to specific cultural preferences and leverage local networks for distribution, propelling their growth.

Beyond Products: Services Take Center Stage: Traditionally, MLM focused on physical products. However, companies for network marketing offering services are gaining traction. Primerica, a financial services MLM, stands out by providing life insurance and investment products. Legal services are another area of growth, with multi marketing companies like LegalShield offering subscription-based access to legal advice through a network of attorneys.

Amway: Despite a slight dip, Amway remains #1 by focusing on sustainability and digital direct selling.

Herbalife: Expanding wellness product lines while maintaining global distributor engagement.

PM International: One of the fastest-growing, thanks to innovative supplements and strong European base.

Utility Warehouse (UK): Demonstrated explosive 47% growth, showing how MLMs in utilities are thriving.

Country:USA

Website: https://www.amway.com/

Products & Services: Health, Beauty & Home Care Products

Founders: Jay Van Andel, Richard DeVos

Achievements:

Country: Brazil

Website: www.natura.com

Products & Services: Beauty Products, Household, Personal Care, Skin Care, Solar Filters, Cosmetics, Perfume & Hair Care Products

Founder: Antonio Luiz Seabra

Achievements:

Country: USA

Products & Services: Personal Care & Wellness, Food & Beverage, Cosmetics

Founder: Mark R. Hughes

Achievements:

Country: USA

Website: https://exprealty.com/

Products & Services: Real Estate

Founders: Glenn Darrel Sanford, Brian Culhane

Achievements:

Country: Germany

Website: www.vorwerk.com

Products & Services: Household Appliances, Fitted Kitchens & Cosmetics

Founders: Carl & Adolf Vorwerk

Achievements:

Country: Luxembourg

Website: www.pm-international.com/en/

Products & Services: Food supplements, Cosmetics

Founder: Rolf Sorg

Achievements:

Country: South Korea

Website: www.coway.com

Products & Services: Water Care, Air Care, Body Care

Founder: Yoon Seok-Keum

Achievements:

Country: USA

Website: https://www.sunrun.com/

Products & Services: Home solar panels and battery storage

Founders: Lynn Jurich, Ed Fenster, Nat Kreamer

Achievements:

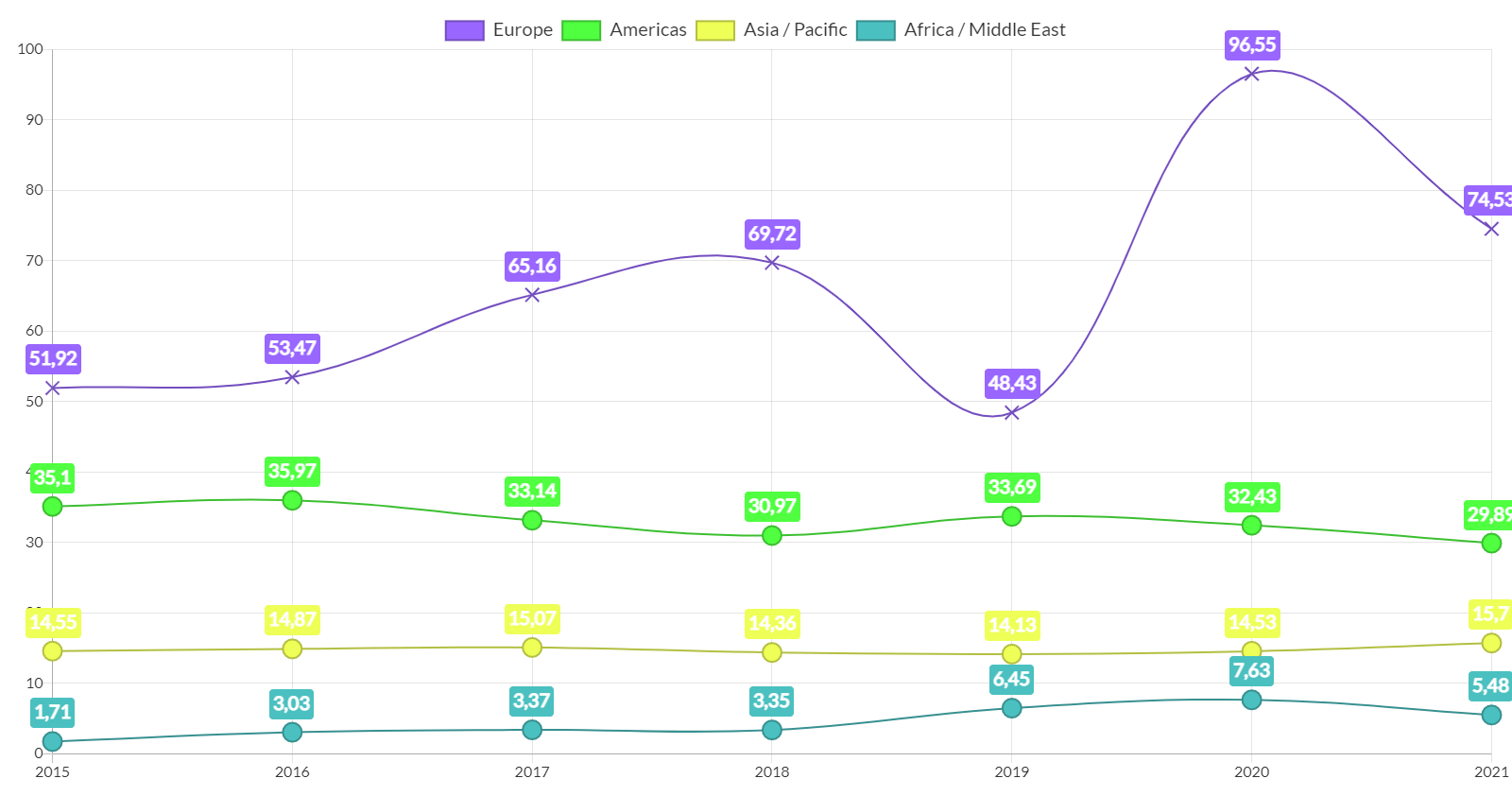

Size of Global Direct Selling Community from 2015 to 2022 by Region

The global direct selling community has experienced significant regional shifts from 2015 to 2022. While established markets like the United States remained strong, the most explosive growth occurred in Asia-Pacific. This region, fueled by a growing middle class and increasing internet penetration, saw a surge in the number of independent representatives. Latin America also witnessed steady growth, capitalizing on a strong entrepreneurial spirit and a culture of relationship-based sales. Europe, on the other hand, exhibited a more moderate increase, with regulations and consumer skepticism playing a role. This regional diversification highlights the evolving landscape of direct selling, where new markets are rapidly claiming a significant share of the global community.

[in Million]

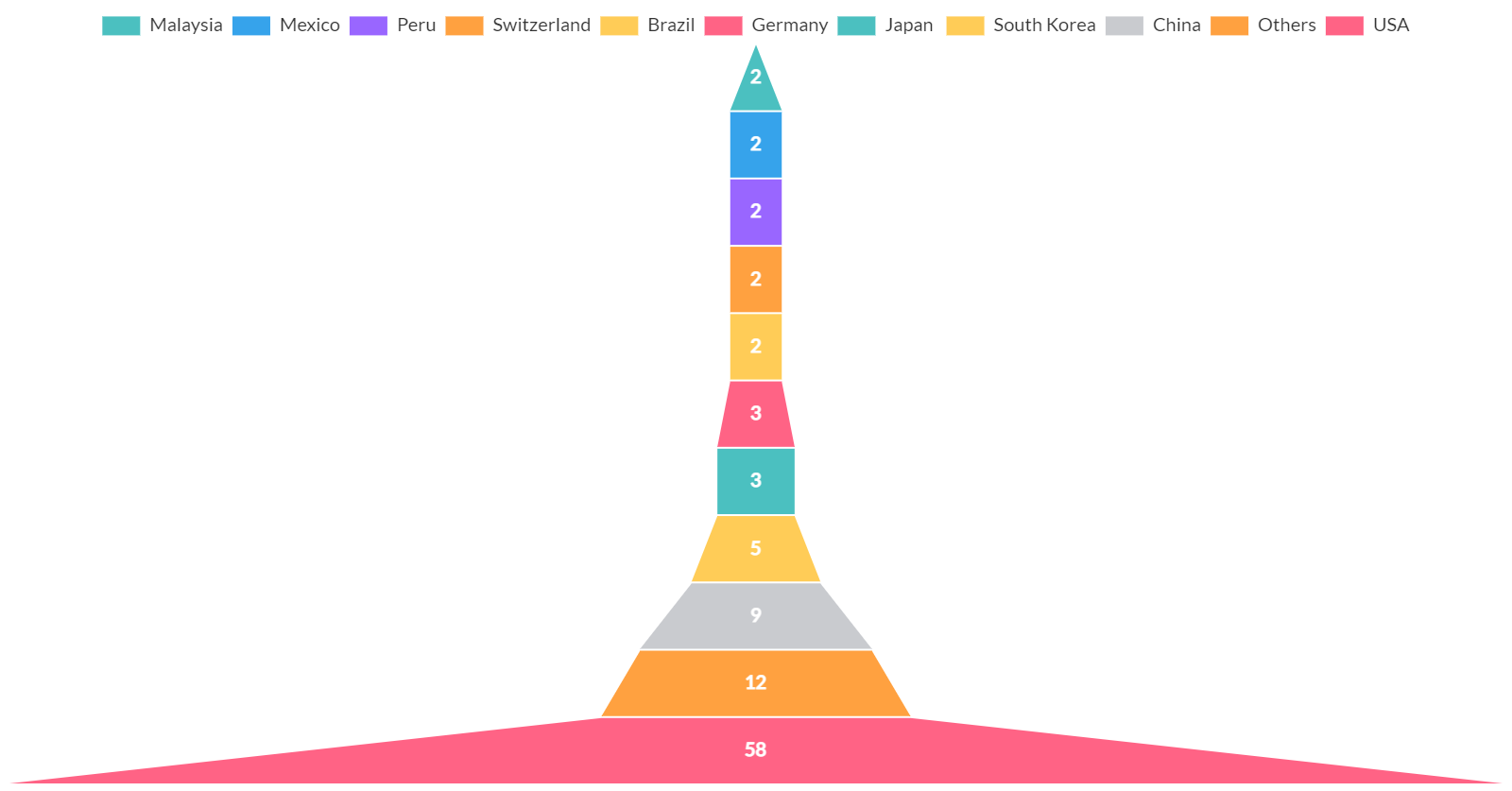

Number of MLM Companies in Different Countries

The landscape of companies for network marketing varies greatly depending on the region. North America has traditionally been a strong market for established players like Amway and Herbalife, while Asia-Pacific is witnessing a surge in interest, particularly for chain marketing company catering to traditional wellness practices and essential oil-based products. Europe has a more cautious approach to MLM, with stricter regulations and a focus on consumer protection. However, established companies for network marketing with strong product lines are finding success by adapting their business models to comply with regional regulations.

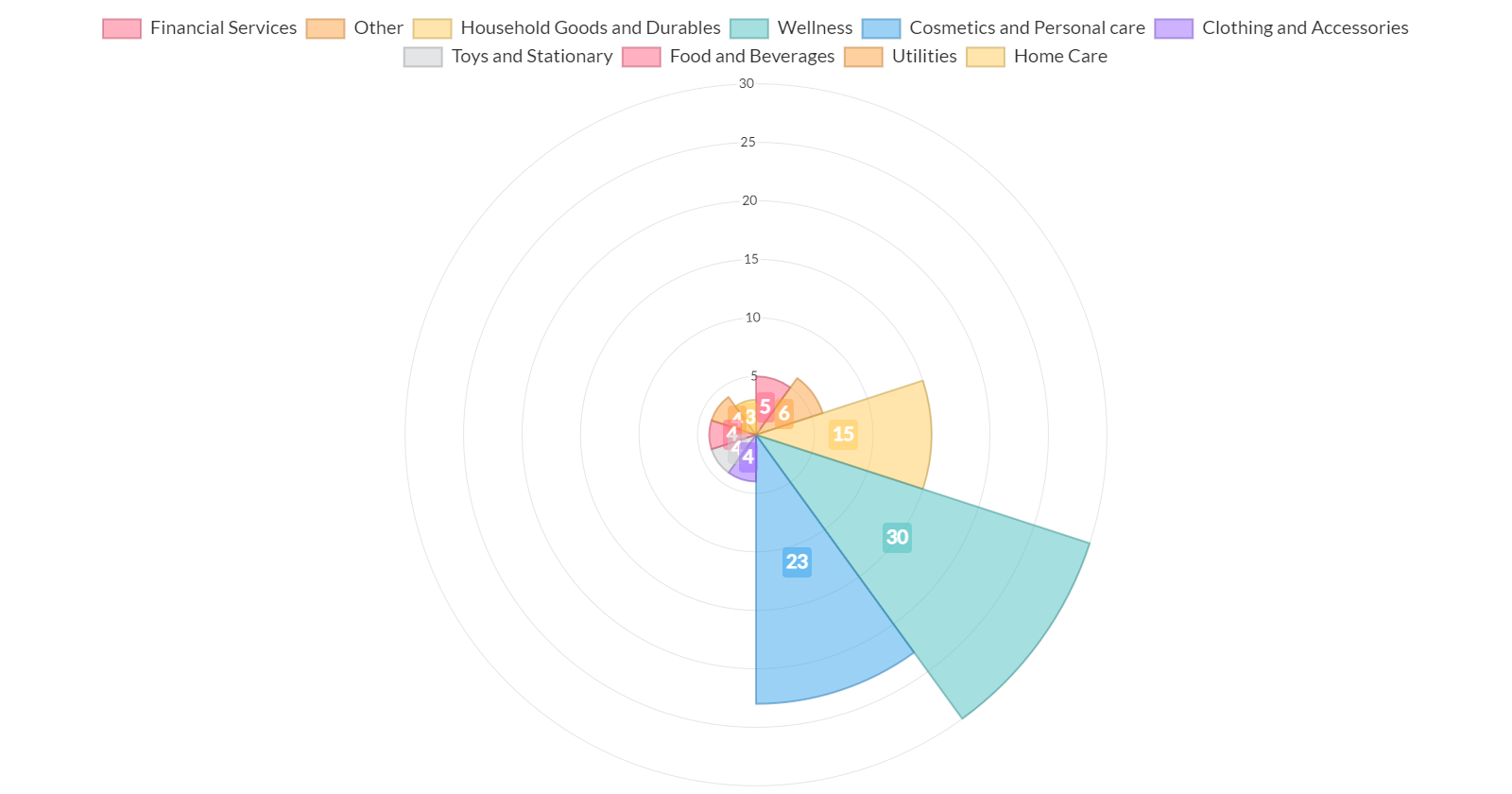

Percentage Breakdown of Popular Products and Services in the Network Marketing Industry

The network marketing industry boasts a diverse range of products and services, but certain categories consistently dominate. Wellness and nutrition products reign supreme, often exceeding 30% of global sales. Beauty and personal care follow closely behind, accounting for roughly a quarter of the market. Household goods and durables hold a steady share, while up-and-coming sectors like financial and legal services are carving a niche. Notably, the breakdown can vary geographically, with essential oils and traditional Chinese medicine showing significant growth in specific regions.

[in Percentage]

[in Percentage]

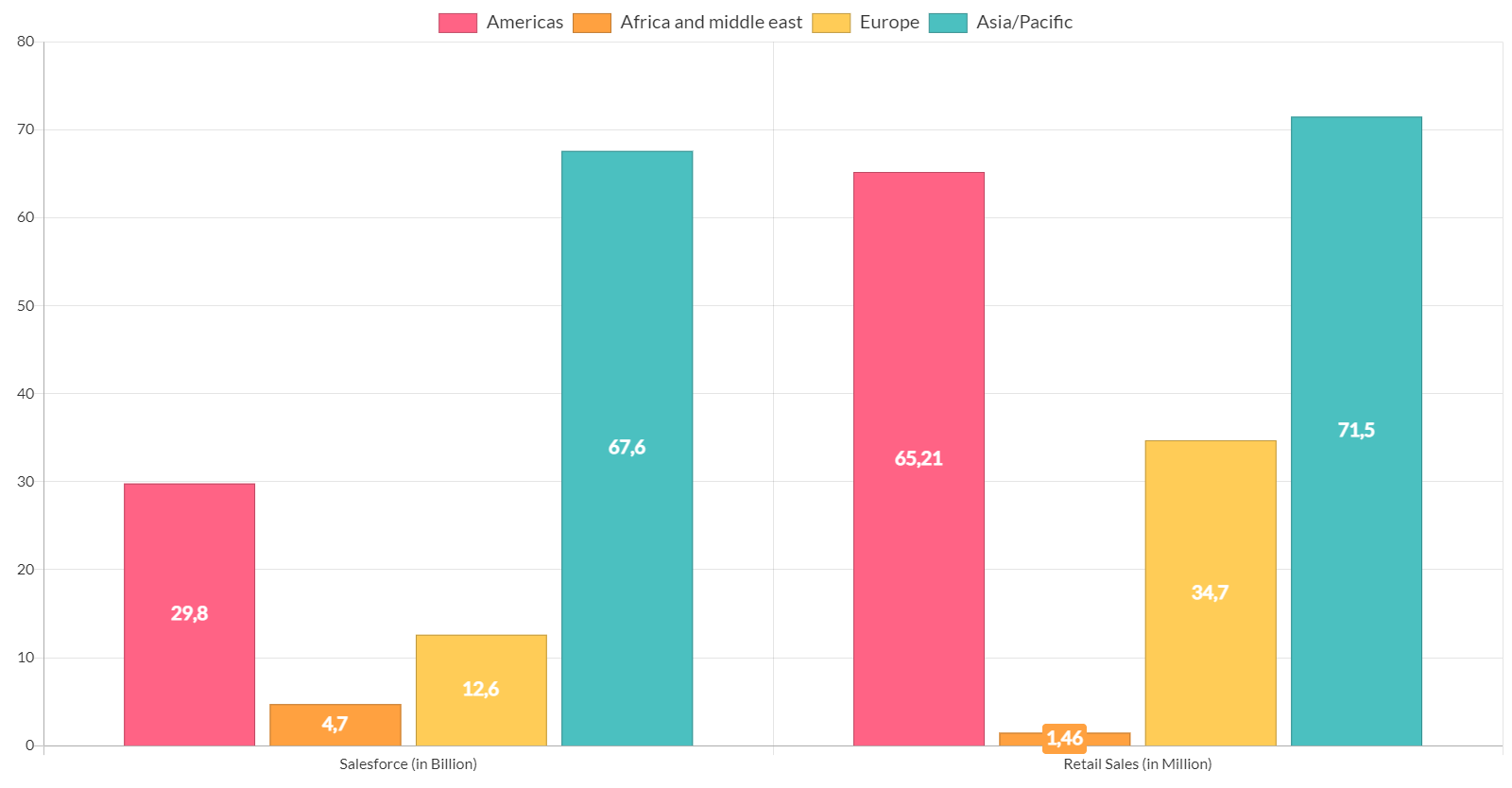

Net Revenue of MLM Industry by Regions Across World

The global MLM industry’s net revenue boasts a geographically diverse landscape. While established regions like North America hold a significant share, the Asia-Pacific market is experiencing a growth surge. This can be attributed to factors like rising disposable incomes, a growing middle class, and a strong entrepreneurial spirit in these regions. Additionally, Latin America and some parts of Africa are showing promising signs of expansion, indicating a potential shift in the industry’s geographic powerhouses.

[in Billion]

[in Billion]

Continent-wise analysis of the global direct selling salesforce and Retail Sales

The global direct selling landscape showcases a fascinating regional distribution of salesforce and retail sales. Asia-Pacific currently leads the pack, boasting a large and engaged distributor base coupled with strong retail sales driven by a growing middle class and a cultural openness to relationship-based selling. North America remains a significant player with established companies for network marketing, while Europe exhibits a more cautious approach, with regulations and consumer preferences impacting growth. Latin America and Africa are emerging markets with promising potential , fueled by entrepreneurial spirit and a growing internet presence that facilitates direct selling models. Each continent presents unique opportunities and challenges, highlighting the dynamic nature of the global direct selling industry.

[Salesforce in Billion / Retail Sales in Million]

[Salesforce in Billion / Retail Sales in Million]

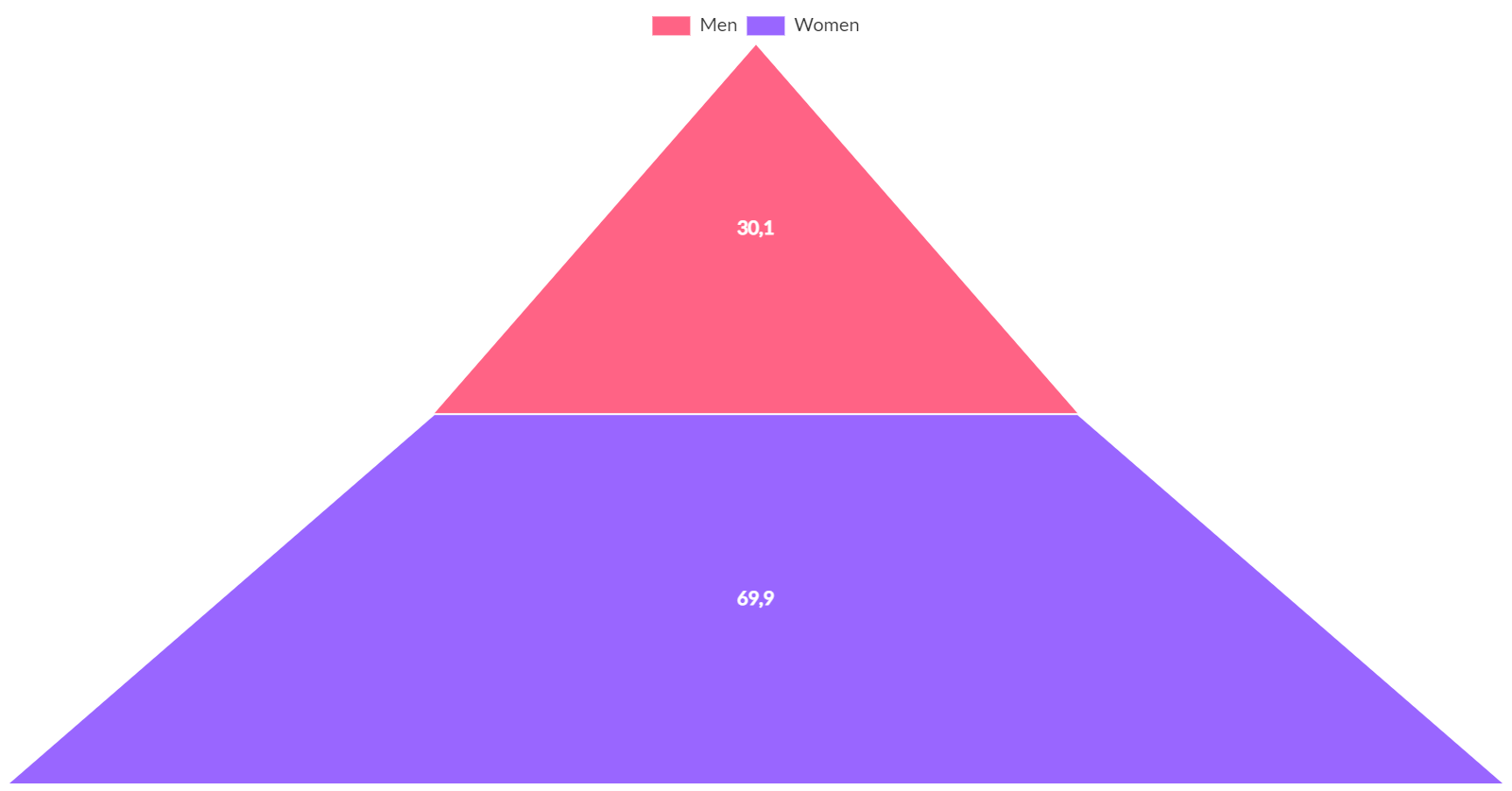

Distribution of People Working in Direct Selling Industry Worldwide by Gender

The direct selling industry boasts a unique gender makeup. Studies suggest women consistently represent a significant majority of the global workforce in direct selling, often exceeding 60% in some regions. This trend can be attributed to several factors. The flexible hours and potential for remote work often align well with childcare and family commitments, making it attractive to many women. Additionally, the relationship-building aspect and emphasis on communication can resonate with female strengths in these areas. However, the industry is not without its share of men, who find success in sectors like financial services and wellness products. As the industry evolves, it will be interesting to see if the gender gap narrows or if the current distribution continues.

[in Percentage]

[in Percentage]

AI & Automation in MLM software – Companies using AI for recruitment and commission tracking are scaling faster.

Hybrid MLM Models – Combining direct sales with e-commerce marketplaces.

Sustainable & Ethical Products – Eco-friendly MLM brands are seeing stronger acceptance.

When selecting an MLM company:

Check financial stability (consistent revenue growth).

Research product demand (health, digital, eco-friendly).

Look for transparent compensation plans.

Prefer companies with global expansion strategies.

💡 Pro Tip: Use our MLM Software Solutions to launch or scale your network business effectively.

FAQs

Q1 — What does “Top MLM Companies 2025” mean?

A: “Top MLM Companies 2025” is a ranked list of direct-selling / multi-level marketing companies ordered by their most recent annual revenue (usually 2024 revenue for a 2025 ranking). The list highlights companies with the largest sales, widest geographic reach, and measurable growth.Q2 — What data is used to rank the companies?

A: Rankings typically use verified annual revenue (USD) for the most recent full year, growth percentage versus the prior year, and sometimes additional signals such as global presence, distributor count, and independent third-party reporting. Reputable industry lists cite company financial reports, Direct Selling News, WFDSA, and BusinessForHome data.Q3 — Why are some revenue figures marked “estimated”?

A: Many private direct-selling companies do not publish audited public financials. Industry aggregators therefore estimate revenue using company filings, distributor disclosures, market research, and regional reports. Estimates are flagged for transparency.Q4 — Are rankings the same across different industry lists?

A: Not always. Different publishers may use slightly different data sources, cut-off dates (calendar year vs. fiscal year), or conversion methods for non-USD currencies. Always check the “data as of” date and source note.Q5 — How often is the Top 100 updated?

A: Most credible lists update annually (reflecting the prior year’s revenue). Some aggregators provide quarterly or rolling updates when companies release new financials.Q6 — Does a higher rank mean the company is a better opportunity for distributors?

A: Not necessarily. Rank reflects company revenue and scale, not the profitability for an individual distributor, the quality of its compensation plan, or compliance practices. Evaluate opportunity by product-market fit, profit margins, churn rates, the compensation plan, and independent distributor reviews.Q7 — How should I use the Top 100 list if I’m choosing an MLM to join?

A: Use the list to shortlist large, stable companies. Then research product demand, compensation plan fairness, distributor support, refund/return policies, legal compliance, and personal fit. Speak with active distributors and look for independent reviews.Q8 — What red flags should I watch for in MLM companies?

A: Red flags include exaggerated income claims, emphasis on recruitment over product sales, high upfront inventory requirements, unclear refund policies, and frequent regulatory actions or lawsuits. Check your country’s consumer protection and direct-selling regulators for any alerts.Q9 — Are MLM and pyramid schemes the same?

A: No. Legitimate MLMs sell genuine products or services to real customers and pay commissions primarily on retail sales. Pyramid schemes focus on recruitment and have little or no real product value. Legal tests vary by jurisdiction; consult regulators or legal counsel if in doubt.Q10 — How is revenue converted when companies report in local currencies?

A: Industry lists convert revenue to USD using a consistent exchange rate (often annual average or end-of-year rate). Conversion method should be disclosed in the list’s methodology.Q11 — Will smaller or newer companies appear on the Top 100?

A: The Top 100 prioritizes revenue, so smaller or newer companies typically appear lower or not at all. However, some fast-growing newcomers may break into the list if their sales scale quickly.Q12 — How can I verify a company’s revenue or founding year?

A: Check the company’s annual report or press releases, filings with regulatory authorities, Direct Selling News coverage, BusinessForHome, and audited financials when available. For founding years, use the company’s “About” page or authoritative business registries.Q13 — Can I use the Top 100 list for competitive analysis?

A: Yes. Marketers and product managers use the list to compare market share, product categories (wellness, beauty, utilities, real estate), regional strengths, and technology adoption. Combine revenue data with distributor counts and product trends for richer insights.Q14 — How do technological trends affect MLM companies in 2025?

A: Digital e-commerce, social selling (TikTok/Instagram), AI-driven lead scoring, automated commission platforms, and virtual events are all reshaping distributor acquisition and retention. Companies investing in modern CRM and fast onboarding tend to scale more efficiently.Q15 — Where can I find the original data source for a specific rank?

A: Good lists cite sources; look for a methodology section and links to BusinessForHome, Direct Selling News, WFDSA, or company reports. If a number is “estimated,” the list should say why and how it was estimated.Q16 — Should I cite the Top 100 on my blog or use the raw data instead?

A: If you republish rankings, always cite the original source and date (e.g., “Data source: BusinessForHome — Top 500 Direct Sales Companies — Data as of Feb 2025”). For transparency, include verification flags and links to company pages when available.Q17 — How can I get notified when the next Top 100 update is published?

A: Follow industry sites like BusinessForHome, Direct Selling News, and WFDSA. Subscribe to their newsletters and set Google Alerts for “top direct sales companies” or specific company names.

The MLM industry in 2025 is not just surviving—it’s evolving with

technology, social selling, and sustainable products.

By tracking the top 100 MLM companies, entrepreneurs and distributors can align with the strongest brands or spot rising opportunities.

👉 Ready to build your own MLM success story? Explore our

custom MLM software solutions to empower your network.

Contact Prime MLM Software today

to start your journey.