⚠️ Fraud in MLM tends to take forms like:

Given these risks, MLM operators must do more than rely on manual audits — they need automated, scalable, and intelligent mechanisms to detect and prevent fraud before it causes damage. This is where predictive analytics steps in.

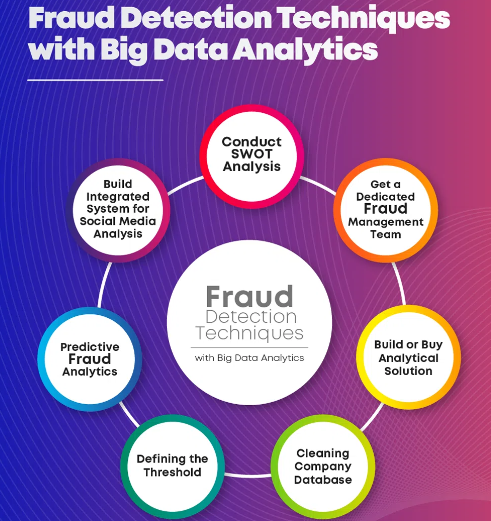

Predictive analytics refers to applying statistical techniques, machine learning (ML), data mining, and pattern recognition on historical and current data to forecast future events. In fraud detection, the idea is to build models that assign a “fraud risk score” to new transactions, enrollments, or behaviors—thus allowing the system to flag suspicious activity in real time or near real time.

However, predictive systems are not foolproof and must be combined with manual oversight and audits.

Models require large, clean datasets with correct labels (fraudulent vs legitimate). In many MLMs, fraud data may be sparse or inconsistently documented, making supervised learning harder.

Fraudsters adapt rapidly, especially with generative AI, social engineering, and adversarial strategies.

Predictive systems must avoid bias (e.g., wrongly penalizing certain geographies or user groups). Explainable AI (XAI) techniques (SHAP, LIME, etc.) are increasingly critical.

Other vital concerns include false positives / customer friction and regulatory & privacy constraints.

| Stage | Action / Component | Purpose |

|---|---|---|

| Data ingestion & aggregation | Combine data from enrollment forms, transaction logs, commission payouts, geolocation, device fingerprints, network linkage (who recruited whom), login behavior, etc. | To build a rich dataset capturing all relevant dimensions. |

| Feature engineering | Derive features like: rate of recruitment, average order value, network depth, ratio of personal sales vs volume from downline, time‑of‑day patterns, etc. | Captures signals that differ between normal vs suspicious behavior. |

| Modeling & scoring | Use a blend of models (logistic regression, random forest, gradient boosting, neural networks). | Generate fraud risk scores for each new event. |

| Thresholding & risk tiers | Define thresholds: safe, review, block. Implement a review workflow where “medium risk” goes to human audit. | To manage false positive risk while intervening on suspicious cases. |

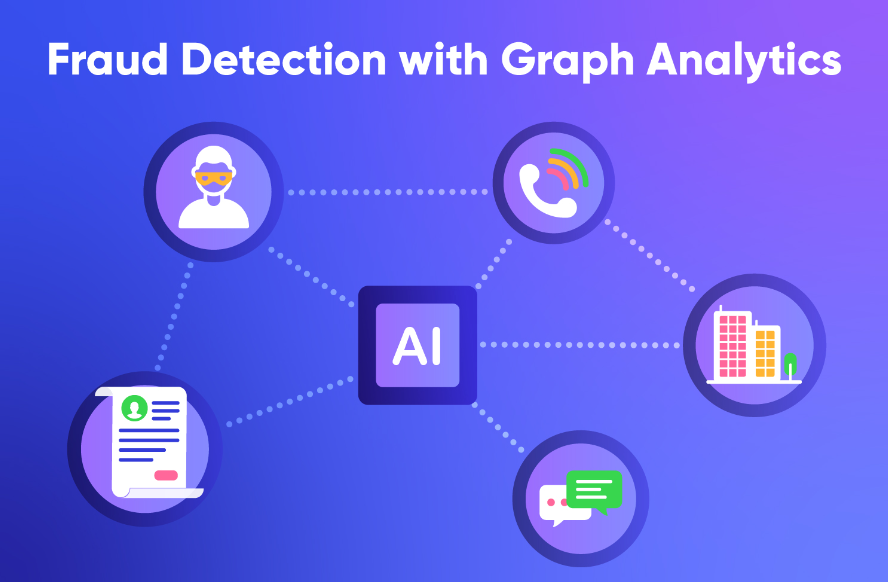

| Graph analytics / link analysis 🕸️ | Identify suspicious network patterns: clusters of accounts with unusual connectivity, reciprocal enrollments, loops, referral rings. | Many MLM frauds manifest via relational patterns, not just single‑account anomalies. |

💡 Cutting‑Edge Insight: Recent state‑of‑the‑art approaches emphasize hybrid architectures, combining sequential models (RNNs, Transformers) with anomaly detection modules. A 2025 study showed a Mixture‑of‑Experts (MoE) architecture achieved 98.7% accuracy.

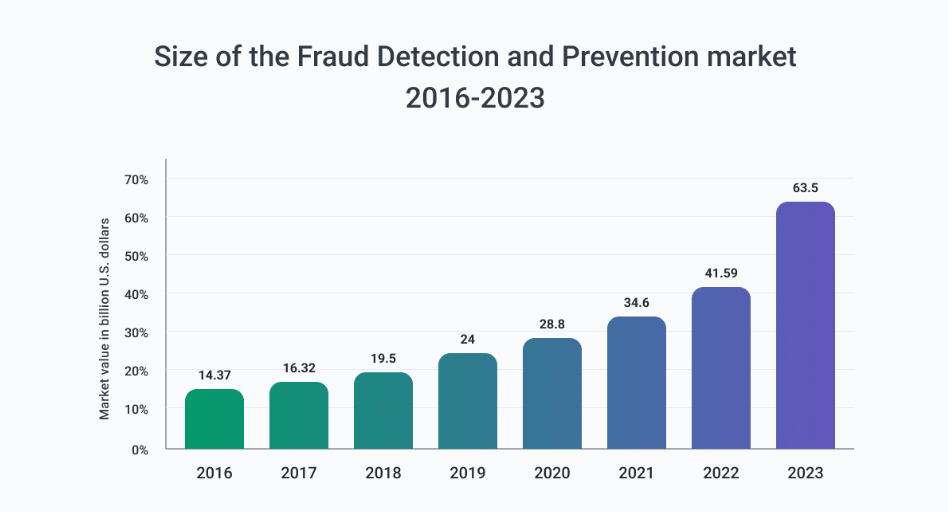

The global fraud detection & prevention market was valued at ~USD 33.13 billion in 2024 and is forecast to reach ~USD 90.07 billion by 2030, at a CAGR of ~18.7%. These figures reflect strong institutional appetite for predictive fraud systems, and by extension, they validate the investment case for robust fraud defenses in niches like MLM.

👉 Try the official MLM Software Demo for Your MLM Business

and experience what MLM Software looks like when it’s powered by the best.

💌 Or, check out our blog to compare top direct‑selling companies, get insider reviews, and learn how to grow your income ethically in the wellness niche.

Fraud is a real and present danger in MLM systems, often manifesting via relational network structures rather than simple anomalies.

Predictive analytics — combining supervised learning, anomaly detection, and graph modeling — offers a scalable, adaptive defense. Success depends not just on model accuracy, but on clean data, human workflows, transparency, and continuous monitoring.

Answer: Predictive analytics in MLM systems uses AI and statistical models to identify patterns and predict potential fraud before it occurs. It analyzes recruitment data, transaction histories, and behavioral anomalies to flag suspicious activities automatically.

Answer: Predictive analytics prevents fraud by detecting irregularities such as fake accounts, network loops, and abnormal recruitment rates. It assigns a fraud‑risk score and alerts administrators for real‑time investigation, reducing financial losses.

Answer: AI enables real‑time fraud prevention, reduces false positives, improves transparency through explainable models, and adapts continuously as fraud patterns evolve.

Answer: Common metrics include fraud risk score accuracy, false positive rate, model recall, precision, and overall AUC‑ROC. These help measure how effectively the model identifies fraud while minimizing disruptions to genuine users.

Answer: Many modern fraud prevention tools offer scalable, pay‑as‑you‑go options. Smaller MLMs can start with affordable cloud‑based AI analytics services before investing in advanced enterprise models.