Shaklee is one of the veterans in the health, nutrition, and direct-selling space. Founded in 1956 by Dr. Forrest C. Shaklee, it has long promoted natural nutrition, wellness, and environmentally friendly home products.

Headquartered in Miami, Florida, it operates globally across multiple markets, with distributors, members, and customers using its platform to buy products or build businesses.

However, like many direct selling brands today, its MLM (multi-level marketing) structure is both a point of appeal and of controversy. Let’s dive into how it works, what data shows, and what someone considering “the business side” should know.

Shaklee markets a broad range of wellness and personal care lines, including:

These categories reflect where consumer demand has been growing: wellness, “clean” beauty, and green home care.

Importantly, in May 2025, Shaklee made a bold move by acquiring Modere’s business, thereby securing rights to Modere’s key brands such as Liquid BioCell® Collagen and Trim. This gives Shaklee more leverage in the collagen / beauty supplement vertical, which is one of the faster-growing sectors in wellness.

On the quality front, there is some mixed feedback. Independent bodies like ConsumerLab have evaluated dietary supplements broadly (including brands like Shaklee) and flagged that 20–30% of tested supplements in the market have potency or labeling issues. That doesn’t single out Shaklee, but it’s a caution that even reputable brands can face scrutiny.

Public financial transparency is limited (as Shaklee is private), but some data points provide glimpses:

So, while Shaklee is not among the massive “wellness giants” by revenue, it maintains a steady base in its niche and is making expansion moves (e.g. via acquisition and product development).

Shaklee is also a member of the Direct Selling Association (DSA) and highlights its long history as a pioneer in integrating environmental responsibility (e.g. offsetting carbon emissions) into its brand messaging.

This is where many observers and potential participants focus: the Shaklee distribution (MLM) system.

In Shaklee’s model, people can join as:

The company provides digital tools such as personal storefronts, Shaklee login portals, mobile apps, training, and sample shipping. Ambassadors typically start with a Business Starter Kit (often ~$49.95) plus optional product packages.

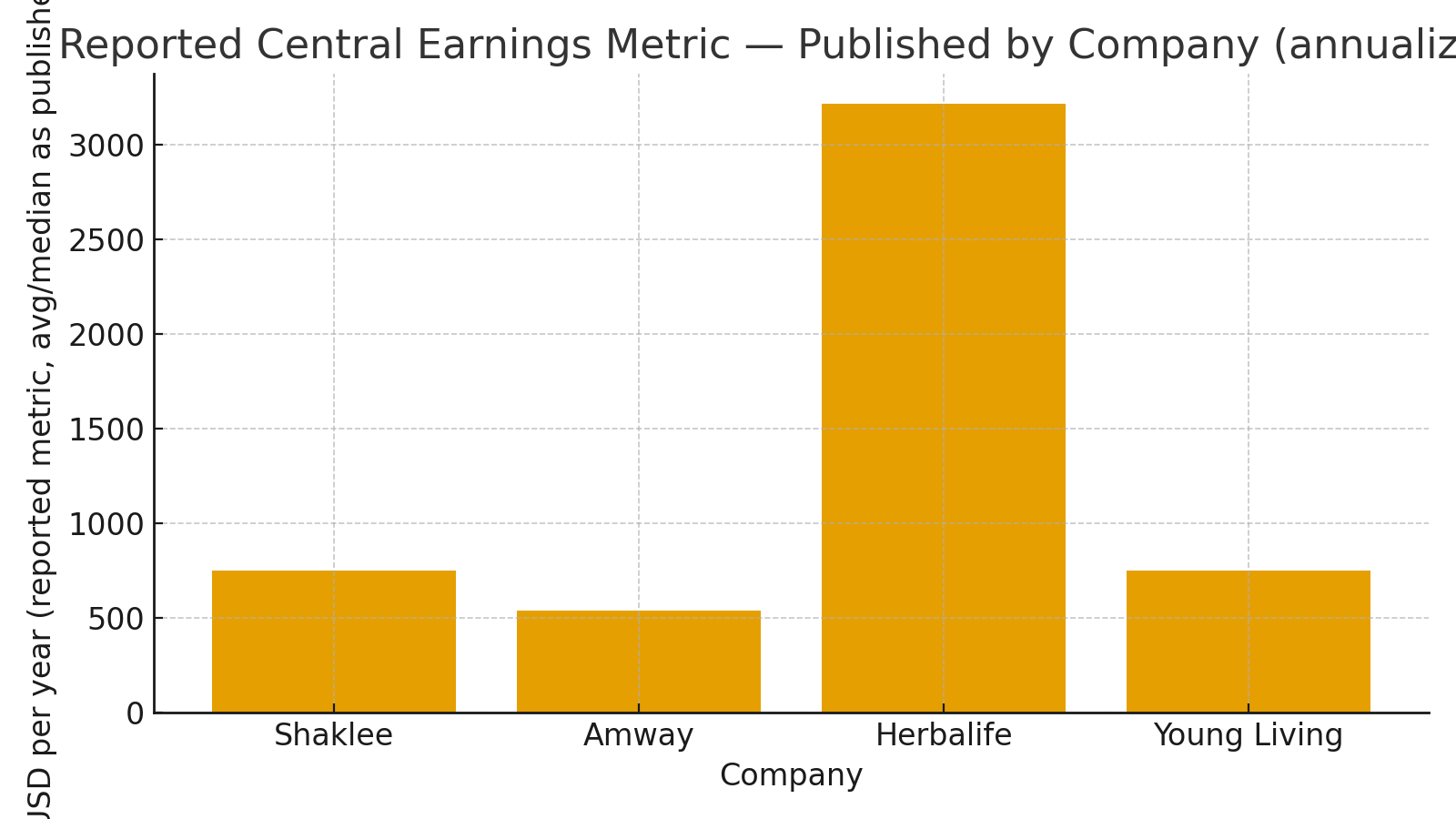

Shaklee publishes an Average Annual Earnings Statement to give participants visibility into how much distributors at different ranks make (or don’t make).

Some key points:

However, many distributors never reach high ranks. Because of the multi-tier nature, rewards tend to accrue disproportionately to early entrants and top leaders. Critics often point this out in their MLM analyses.

A Reddit comment summarizes a common critique:

“Shaklee has 13 levels in their MLM. That’s insane. … The more levels the more payouts go to the uplines. Also, the longer they’ve been around the less chance you have of actually making money.”

BehindMLM’s review also highlights costs and “mandatory purchases” as hurdles: some distributors may feel pressured to keep buying inventory or qualify with quotas.

Some commonly raised concerns include:

That said, Shaklee has existed for decades (since 1956) and has weathered many regulatory and industry shifts.

If you or someone reading this is evaluating Shaklee as a business opportunity, here are critical questions to dig into:

| Question | Why It Matters |

|---|---|

| What is the rank advancement curve and how many people reach higher ranks? | Indicates how realistic high earnings are. |

| What are the ongoing costs (mandatory volume, inventory, shipping)? | Some distributors may lose money if costs outweigh earnings. |

| What proportion of earnings come from personal sales vs. team commissions? | Helps determine balance between selling and recruiting. |

| Does Shaklee publish a clear income disclosure and compensation statement? | Transparency is vital in evaluating MLM legitimacy. (Yes — Shaklee publishes its Average Annual Earnings Statement) |

Shaklee is a mature, well-known brand in the wellness space. Its history, product range, and environmental identity give it legitimacy beyond many newer MLMs. The recent acquisition of Modere’s business signals ambition and adaptability.

However, the direct selling / MLM side has the usual caveats: the majority of income is concentrated in the upper echelons, recruitment is a major driver, and costs and expectations are often higher than new distributors anticipate. The system rewards scalable leadership more than scattered individual sellers.

For those seriously considering joining Shaklee distribution, success will depend heavily on:

👉 Try the official MLM Software Demo for Your MLM Business

and experience what MLM Software looks like when it’s powered by the best.

💌 Or, check out our blog

to compare top direct-selling companies, get insider reviews, and learn how to grow your income ethically in the wellness niche.

What is Shaklee and how does its MLM (direct selling) model work?

Answer summary: Shaklee is a wellness company offering supplements, household products, and beauty care via direct selling. Distributors (Ambassadors) sell to customers and recruit others, earning commissions, bonuses, and rebates under a tiered compensation plan.

Are Shaklee products safe and are there scientific studies backing them?

Answer summary: Shaklee claims high standards for quality, uses natural ingredients, and provides efficacy data for many supplements. However, independent reviews should be consulted; regulatory oversight varies by country.

How much can you realistically earn with Shaklee distribution?

Answer summary: Earnings vary widely. Shaklee publishes average and median earning statements. Many distributors earn modest amounts; only a minority reach top ranks with high incomes. Costs like inventory, shipping, and recruitment effort must be considered.

What are the costs and requirements to become a Shaklee distributor?

Answer summary: There are starter kits, registration fees (which vary by country), possible minimum monthly purchases or quotas, and the need for consistent sales and recruitment to access higher bonuses.

How does Shaklee compare to other MLM companies like Amway or Herbalife?

Answer summary: Differences lie in product lines, commission plans, enrollment costs, focus on recurring customers versus recruiting, and regulatory disclosure practices. Shaklee tends to emphasize product quality and environmental sustainability, though similar challenges in income disparity remain.