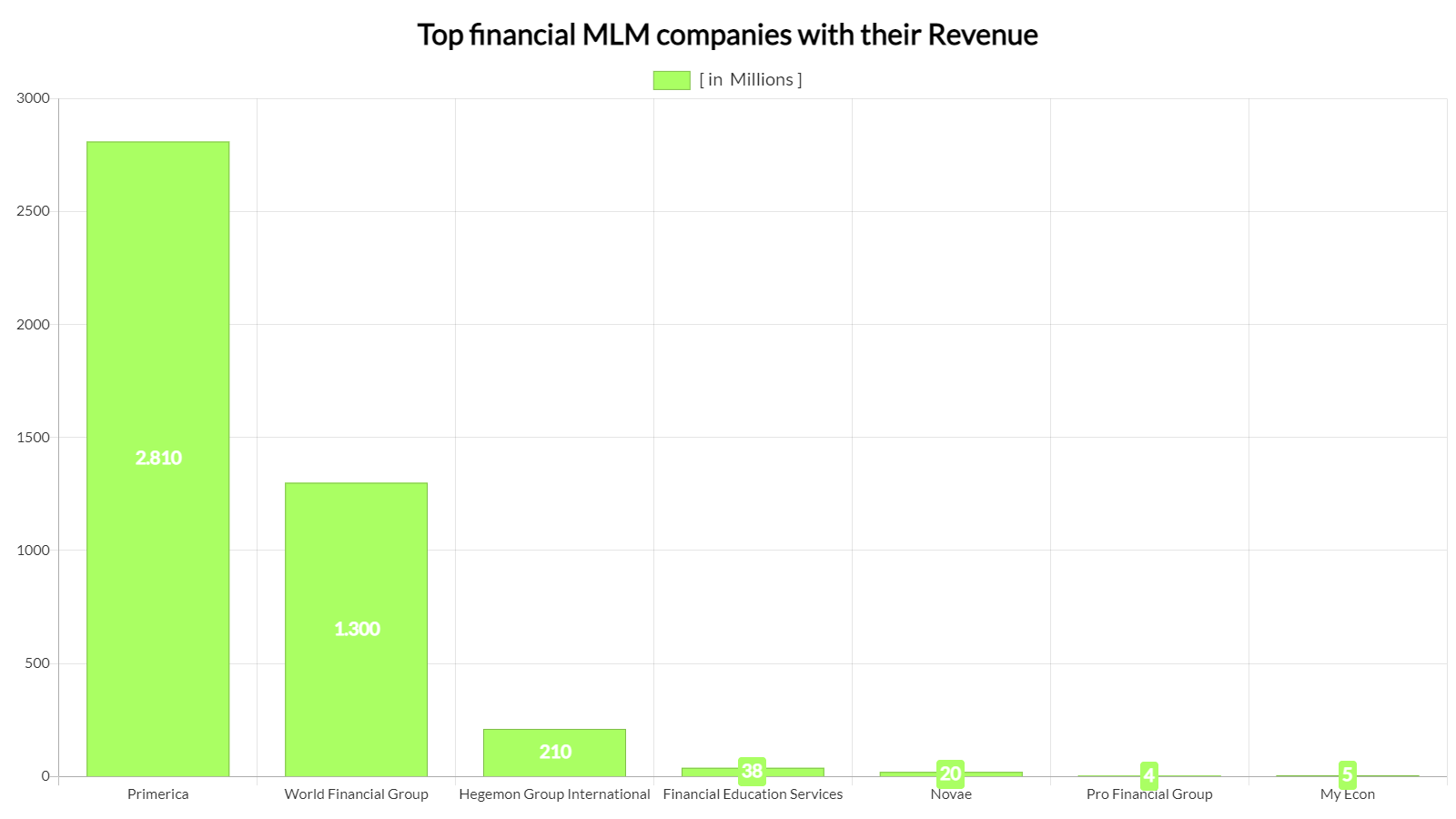

Multilevel marketing, also known as network marketing, is a business model in which independent distributors market a company’s products or services and earn commissions on their sales and the sales of their recruits. Let’s examine some of the top Financial MLM companies that are making great strides in the industry.

Financial multi-level marketing (MLM) companies have experienced significant growth in recent years. Several key trends have contributed to this upward trajectory:

Primerica

Founder: Arthur Williams Jr.

Year Founded: 1977

Headquarters: Duluth, Georgia, USA

Products: Life insurance, annuities, mutual funds, and other financial products

Achievements: One of the largest independent financial services marketing firms in North America

Revenue: Approximately $2.8 billion (2023)

A well-established financial services company offering life insurance, annuities, and investment products. Primerica’s MLM model empowers its representatives to build their own businesses and earn commissions through recruiting and sales.

World Financial Group (WFG)

Founder: Todd Buchanan

Year Founded: 1985

Headquarters: Greensboro, North Carolina, USA

Products: Life insurance, annuities, mutual funds, and other financial products

Achievements: Significant growth and expansion over the years

Revenue: $1,300 million

WFG focuses on wealth management, retirement planning, and insurance solutions. Their MLM structure enables representatives to grow their network and generate income through commissions and bonuses.

Novae Money

Founder: Reco McDaniel McCambry

Year Founded: 2017

Headquarters: USA

Products: Loans, insurance, and investment products

Achievements: Rapid growth in recent years

Revenue: $20 million

A relatively newer entrant, Novae Money offers financial services like loans, insurance, and investment products. Their MLM model allows distributors to earn commissions on sales and recruit new members.

Hegemon Group (HGI)

Founder: Hubert Humphrey

Year Founded: 2012

Headquarters: Not publicly disclosed

Products: Diversified financial services, including investment products and real estate

Achievements: Expanding its global footprint

Revenue: $210 million

HGI is a diversified financial services company offering a range of products and services. Their MLM model incentivizes distributors to recruit new members and drive sales.

Financial Education Services

Founder: Parimal Naik

Year Founded: 1988

Headquarters: USA

Products: Financial education and training programs

Achievements: Helping individuals achieve financial independence

Revenue: $38 million

This company focuses on providing financial education and training. Their MLM structure rewards distributors for recruiting new members and promoting financial literacy.

Pro-financial group

Founder: Dr. Dominigo Herrera

Year Founded: 2018

Headquarters: Charlotte, North Carolina, USA

Products: Financial services, real estate, and education services

Achievements: Helping individuals achieve financial independence

Revenue: $4 Million

Pro-financial group aims to help individuals achieve financial security through passive income from rental properties. They offer various investment options to suit different financial situations, including those with limited start-up capital.

My Econ Inc

Founder: Ivey Stokes

Year Founded: 2005

Headquarters: Gwinnett County, Georgia, USA

Products: Financial services, Cash Flow Manager, ID Defender, Insurance Policies, Travel Memberships, etc.

Achievements: Helping individuals achieve financial independence

Revenue: $5 Million

The company emphasizes building a network of independent distributors who can earn income through product sales and recruiting new members into their downline.

Several factors contribute to the growing popularity of financial MLMs:

While financial MLMs offer attractive opportunities, it’s important to be aware of the potential risks:

Before joining a financial MLM, it’s important to do thorough research, understand the company’s business model, and evaluate the potential risks and rewards