Multi‑Level Marketing has always hinged on people, momentum, and trust. In 2025, AI‑driven competitive intelligence (CI) and benchmarking are the next frontier — turning scattered signals into strategy, surfacing competitor moves in real time, and enabling smarter incentive, product, and expansion decisions. This article walks you through frameworks, benchmarks, real use cases, and the trends shaping CI for the MLM space.

On this page

⚙️ Complexity of modern MLM ecosystems

MLMs now span geographies, product verticals (wellness, crypto, skincare, education), and digital channels (eCommerce, social, webinars). Manual tracking can’t keep pace; AI ingests large volumes of unstructured data (social, forums, news, filings) and turns them into actionable signals.

⏱️ Speed matters

A competitor’s incentive can become a market event in days. AI flags shifts immediately (e.g., spikes in social buzz or compensation changes), creating first‑mover advantage.

📈 Data‑driven decision support

Benchmark your recruitment growth, retention, ARPU, and churn against mapped peer cohorts using AI clustering — producing realistic “best‑in‑class” benchmarks instead of guesswork.

🔮 Predictive foresight

Advanced models can forecast competitor moves or simulate “what‑if” scenarios: if competitor X launches an incentive, what’s the projected impact on your churn and acquisition costs?

Implementing AI‑based benchmarking follows a stage‑by‑stage pipeline:

| Stage | Description | Example in MLM |

|---|---|---|

| Define objectives & KPIs | Choose what to benchmark (recruitment velocity, retention %, ARPU, churn) | Average monthly recruits per top 5% rep in competitor A |

| Select competitor set & cohorts | Pick rivals by geography, niche, or growth stage | Health & wellness MLMs in India, or crypto‑MLMs globally |

| Data ingestion & normalization | Gather public & private signals (web scraping, forum, social, filings) | Social sentiment about competitor launches, forum chatter on pricing |

| Signal extraction | Use NLP, anomaly detection, clustering to derive features | Detect discussion spikes tied to “bonus week” |

| Benchmark model & clustering | Compare metrics across peer clusters, generate top decile/median benchmarks | Top 10% of MLMs achieve 15% monthly retention; your network has 8% |

| Dashboards + alerts + simulation | Real‑time dashboards + “what‑if” simulators | Simulate competitor raising commission by 2% and its impact |

| Feedback loop | Continuous improvement, human validation | Analysts review flagged signals to reduce noise |

This pipeline creates an ongoing CI function — not sporadic reports — giving you continuous competitive visibility.

Direct public data on private MLMs is scarce, but macro CI and digital marketing benchmarks help triangulate realistic targets and expectations.

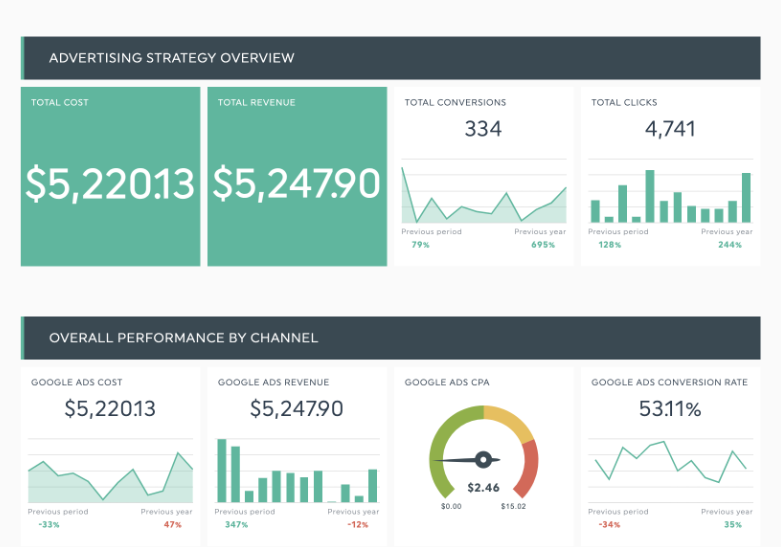

Below are proxy digital marketing benchmarks useful when overlaying MLM funnels (ads → landing → signup → conversion to rep):

| Metric | Bottom 25% | Median | Top 10% | Your Current |

|---|---|---|---|---|

| New Recruits/month per active upline | 5 | 10 | 20 | 8 |

| Rep attrition rate (monthly) | 10% | 6% | 3% | 7% |

| Personal sales per rep/month (USD) | 200 | 400 | 800 | 350 |

| Downline volume growth (%) | 5% | 12% | 25% | 9% |

| Customer retention (%) | 65% | 80% | 90% | 75% |

Incentive / compensation plan design

CI systems can flag rival incentive events (e.g., “double commission week”) and let you simulate matching or counter‑offers, estimating retention effects and cost.

Product / vertical intelligence

If a competitor introduces a crypto reward or a new supplement line, AI detects early signals (registrations, chatter, job posts). Benchmark absorption rates using analogous launches.

Marketing / creative intelligence

Crawl competitor creatives, landing pages, and ad copy; benchmark engagement proxies to inspire tests and guard against being blindsided by new channels.

Sentiment & reputation tracking

NLP models generate competitor reputation indices from forums, reviews, and social — benchmark brand health over time.

Regional rollout & early warning

Signals such as domain registrations, localized social pages, or job listings hint at market expansion before it becomes public. Early alerts let you mobilize local pilots or counter‑offers.

AI complements humans — it doesn’t replace them. Key caveats include:

Winning teams pair mind + machine: AI handles scale and pattern discovery; humans contextualize and decide.

👉 Try the official MLM Software Demo for Your MLM Business

and experience what MLM Software looks like when it’s powered by the best.

💌 Or, check out our blog

to compare top direct-selling companies, get insider reviews, and learn how to grow your income ethically in the wellness niche.

AI‑driven CI + benchmarking gives MLMs real‑time signal detection, proactive strategy, and data‑based benchmarks. While direct public MLM data is limited, proxy metrics and AI models bridge the gap. Use cases span incentive design, product intelligence, marketing monitoring, and regional expansion. The right approach balances AI scale and speed with human judgment to avoid noise and compliance pitfalls.