An analysis of the business structure, success stories, and inherent risks associated with the company’s independent fashion retail network.

LuLaRoe is a clothing company founded by DeAnne Stidham, known for its brightly patterned leggings, dresses, skirts, and other comfortable apparel. It has built its business not via traditional stores or its own website, but via a network of independent resellers called “consultants” or “independent fashion retailers.” Many of these resellers are millennial moms.

The company utilizes a standard multi-level marketing (MLM) model. Key elements of this structure include:

This structure—buying inventory, selling to customers, and recruiting/leading others for bonuses—attracts many due to the promise of flexible, work-from-home income, particularly for mothers seeking supplemental earnings.

Markup & Profit Margins

Consultants purchase inventory at wholesale prices and apply a markup when reselling, resulting in profit margins often ranging from 45% to 60% of the final sale price.

Sales Volume

Top performers report exceptionally high sales figures. For example, Alexandra Laigle reported selling 800–1,000 pieces per month, equating to roughly US$80,000 worth of clothing sold monthly out of her home.

Average/Median vs. Top Earners

A wide income gap exists between top earners and the average consultant:

Alexandra “Alex” Laigle and her husband Matthew (“Matty”) are frequently cited as a major LuLaRoe success story, illustrating the potential high end of the MLM earnings spectrum.

Success Highlights

Marketing Techniques

The Laigles employed aggressive and effective tactics early on:

Despite the impressive success stories, the MLM model carries significant risks and has faced substantial criticism:

Given the upheavals at LuLaRoe, how might their position and public narrative have shifted since the earlier peak years?

Transition & New Ventures

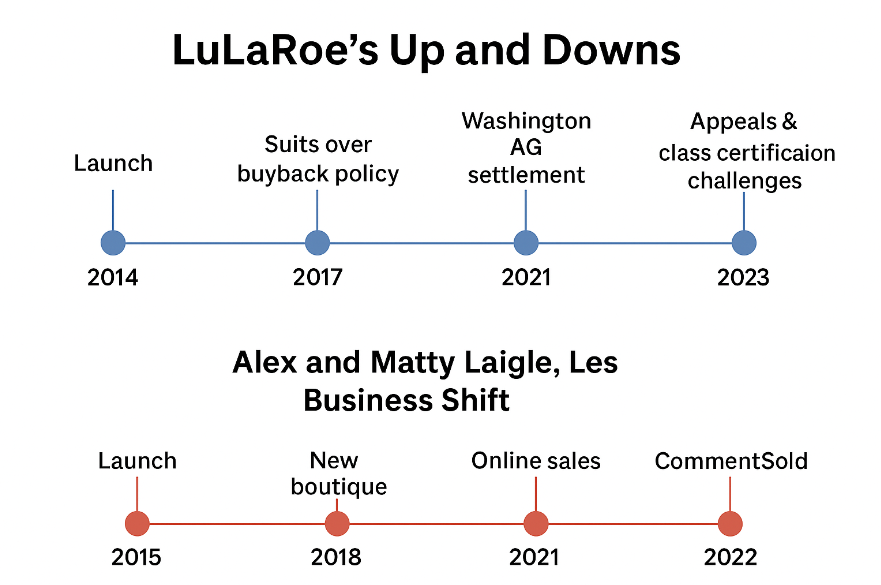

The Laigles appear to have evolved beyond solely LuLaRoe. Alexandra’s Instagram handle is now “Laigle Land”; she describes herself as “CEO of Freckled Poppy, Mom of 4.”

Instagram

Freckled Poppy is (or was) a boutique or retail brand connected to them, and the Laigles also participate in live-selling platforms (e.g. CommentSold).

Instagram (reel)

In public posts, Alex and Matty now present themselves as business influencers/speakers, sharing their journey and leveraging their experience.

Facebook

Shifting partly from direct MLM income to broader entrepreneurial influence is common among top MLM earners once saturation or legal headwinds grow.

Reputation, Criticism, and Public Perception

On forums such as Reddit, there are user comments critical of the Laigles or their affiliated brands (Freckled Poppy). Some commenters describe them as overly focused on image, luxury goods, and being somewhat detached from the on-ground product/warehouse operations.

Reddit

Some claims allege erratic operations, turnover in warehouse or staff, and heavy reliance on social media branding rather than consistent product or logistical excellence.

Reddit

In 2018, a site (Lularoefail.com) published that the Laigles were top buyers of LuLaRoe inventory and had received HOA (Home Owner’s Association) complaints for running a large business from a residential home.

lularoefail.com

These anecdotal critiques don’t necessarily invalidate their prior success, but they suggest that their operations and public image have faced scrutiny.

Earnings Uncertainty vs. Public Claims

While earlier reporting (pre-2017) credited Alex with selling ~800–1,000 pieces/month and receiving bonus checks of ~$21,000, there is less transparent, verifiable data of how much she (or they) currently earn from LuLaRoe or affiliate sales now. The public narrative tends to rely on self-reported claims or influencer branding rather than audited statements.

The legal stress on LuLaRoe’s finances (especially the $164 million verdict) raises the question: can the company continue to support large leadership bonus payouts, maintain inventory, and fulfill consultant support without strain?

If bonus pools or sales incentives shrink, top sellers may see reduced upside or have to shift toward newer business models, consultation, coaching, or new product lines.

LuLaRoe’s model in its boom years tapped into strong consumer engagement (scarcity, novelty, social selling) and empowered many part-time sellers (especially mothers) looking for flexible income.

Some top performers like Alex & Matty demonstrate the upper bound potential: scaling sales volume, recruiting, team-building, and leveraging online/social platforms to amplify reach.

Their stories served as powerful recruitment magnets, promoting the dream of financial transformation through entrepreneurship.

Legal liabilities: The $164 million judgment, state AG settlements, and class action pressures are looming burdens that could force structural changes, cutbacks, or even bankruptcy reorganization.

Reputational damage: Complaints about product quality, changing refund policies, and overly aggressive recruitment have eroded trust.

Model sustainability: As market saturation grows, the ability for new consultants to find fresh, non-redundant customers shrinks. Relying on recruitment becomes riskier legally (as pyramid claims intensify).

Financial pressure: If supply chains, inventory funding, or bonus cash reserves are strained, they might tighten margins or reduce returns to sellers.

The “dream story” of MLM success is becoming harder to sustain in the face of legal scrutiny and structural limits.

Top sellers will likely need to diversify: beyond just product resale, into consulting, training, branding, alternative product lines, or e-commerce.

Transparency, compliance, and risk mitigation will be increasingly important. Consultants should demand clear income disclosures, audit-proofable records, and backup exit strategies.

LuLaRoe serves as a vivid case study demonstrating both the potential high rewards of a successful MLM venture (as seen with the Laigles) and the severe financial risks and challenges for the majority of participants. Success is heavily tied to high volume, effective marketing, and team leadership, which are not guaranteed for newcomers.

Know in Detail @

LuLaRoe is a multi-level marketing (MLM) clothing company known for its colorful leggings, dresses, and other apparel sold by independent consultants. Founded in 2013 by DeAnne Stidham, the company allows sellers to earn money through direct sales and by building downline teams.

Consultants purchase LuLaRoe clothing at wholesale prices and resell them at retail for profit. They can also recruit others, earning bonuses based on team sales. Earnings depend on personal sales, recruitment, and maintaining inventory levels.

Consultants earn through:

Retail profit margins (typically 45–60%)

Leadership bonuses from team sales

Incentive trips and rewards for meeting sales goals

Top performers can reach ranks like Sponsor, Trainer, Coach, and Mentor, unlocking higher bonuses.

Alexandra and Matthew (“Matty”) Laigle are a married couple and among LuLaRoe’s most successful consultants.

Their story was featured in Business Insider for achieving remarkable sales — selling 800–1,000

clothing pieces a month and earning a $21,000 monthly bonus at their peak.

According to Business Insider, Alex Laigle reported monthly sales around

$80,000 and bonus checks exceeding $20,000.

Their success allowed them to leave corporate jobs and build their own retail brand, Freckled Poppy.

LuLaRoe faced lawsuits and regulatory scrutiny over refund policies and pyramid scheme allegations.

The company settled with Washington State in 2021 for $4.75 million and later lost a $164 million

fraud case against a supplier in 2024.

The Laigles have shifted to independent entrepreneurship, running

Freckled Poppy, an online boutique and live-selling brand, while leveraging

their MLM experience to build community-driven retail success.

Yes, LuLaRoe continues to operate, though at a reduced scale. The company has updated its

income disclosure statements and refund policies following lawsuits and settlements.