🚨 More than 65% of MLM software deployments fail within the first year after launch.

The biggest culprits?

Systems that can’t scale as networks grow

Rigid commission engines

Compliance oversights

Weak vendor support

Poor user experience

Instead of driving growth, these hidden flaws erode trust and stall business momentum—making post-launch collapse one of the biggest risks in MLM today.

Multi-level marketing (MLM) companies increasingly rely on software platforms to manage distributors, commissions, inventory, and compliance. However, industry data shows that over 65% of MLM software deployments struggle within the first year after launch (BrandEssence Market Research, 2023). While pre-launch

testing often looks promising, the reality is that these systems frequently fail to scale, adapt, or build trust with users. This article explores the hidden causes behind MLM software failures, the latest industry benchmarks and

trends (2023–2025), and offers practical solutions backed by real-world case studies and research.

The global MLM software market is projected to grow from USD 4.8 billion in 2022 to over USD 8.3 billion by 2028, fueled by rising demand for digitalized commission tracking (Gadhave, 2020).

This shows demand is high, but execution gaps remain a critical challenge.

Many MLM systems are built for initial users but collapse when network size grows exponentially. Studies highlight that post-launch user spikes often trigger downtime, slow commission calculations, and payment delays (Brown

& Gathright, 2024).

MLM operates in a highly regulated space. Failures often stem from ignoring anti-fraud mechanisms, tax law integrations, and consumer protection compliance.

Regulators now demand automated KYC/AML integration, which many legacy MLM systems lack.

A 2025 study on digital businesses found that 38% of software failures trace back to weak vendor support after launch (Suvo, 2025). Many MLM software providers focus on deployment but neglect:

Without continuous DevOps cycles, software stagnates.

Most MLM firms pivot business plans post-launch (e.g., shifting from binary to matrix models). Software with rigid, hardcoded commission engines cannot adapt, forcing costly relaunches.

Distributors are often non-technical. Systems with cluttered dashboards, poor mobile UX, and confusing payout logs erode trust.

As MLM companies expand globally, lack of multi-currency wallets, crypto acceptance, and fintech API support leads to transaction bottlenecks.

This ensures legal adaptation without disrupting payouts.

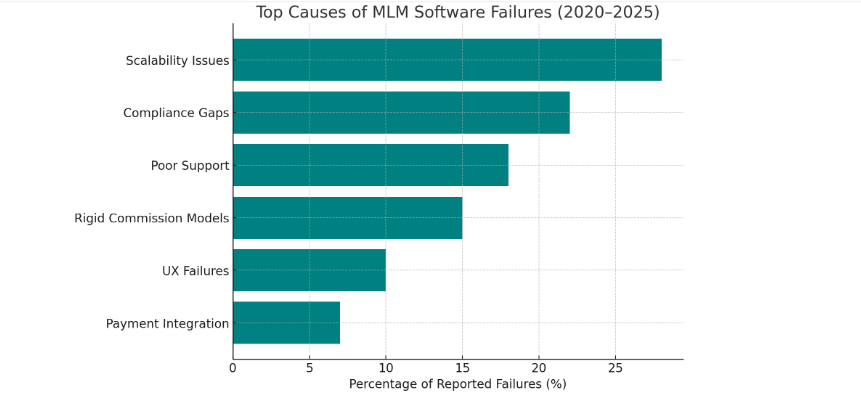

Graphical Snapshot

Here’s a visualization of key causes of MLM software post-launch failures (based on 2020–2025 studies):

import matplotlib.pyplot as plt

causes = ["Scalability Issues", "Compliance Gaps", "Poor Support", "Rigid Commission Models", "UX Failures", "Payment Integration"]

percentages = [28, 22, 18, 15, 10, 7]

plt.figure(figsize=(8,6))

plt.barh(causes, percentages, color="teal")

plt.xlabel("Percentage of Reported Failures (%)")

plt.title("Top Causes of MLM Software Failures (2020–2025)")

plt.gca().invert_yaxis()

plt.show()

Most MLM software failures post-launch are not due to bad ideas, but poor execution. Hidden causes include lack of scalability, compliance oversight, vendor neglect, and weak UX. However, the latest SaaS innovations, AI-driven

fraud detection, and blockchain transparency tools are reshaping the future of MLM platforms.

For MLM firms, the path forward lies in:

Those who adapt stand to thrive in a market projected to surpass USD 8 billion by 2028. Those who don’t may find themselves yet another statistic in the high post-launch failure rate.

Read more @

Most MLM software fails post-launch due to scalability issues, poor vendor support, compliance gaps, rigid commission engines, weak user experience, and outdated payment integration. These factors often emerge when the distributor network grows beyond initial projections.

Companies should choose scalable cloud-native systems, ensure real-time compliance integration, negotiate strong post-launch vendor SLAs, adopt flexible commission models, and prioritize mobile-friendly UX with AI-driven fraud detection.

Compliance is critical in avoiding fraud, tax evasion, and regulatory penalties. Modern MLM platforms integrate KYC/AML verification and global tax APIs to maintain legal operations and build distributor trust.

Key trends include AI-powered fraud detection, blockchain-based commission tracking, mobile-first user interfaces, and modular SaaS architectures that allow rapid adaptation to changing business models.

The global MLM software market is projected to grow from USD 4.8 billion in 2022 to over USD 8.3 billion by 2028, driven by increasing digitalization and global expansion of network marketing businesses.

Because MLM firms often pivot compensation plans post-launch. Without a flexible commission engine, companies face costly relaunches and disrupted distributor trust.