When your MLM business starts juggling complex downlines, multi-level commissions, and expanding markets, a standard CRM simply can’t keep up. While CRMs are designed to manage customer relationships and sales pipelines, MLM software is purpose-built to handle the unique structure of network marketing — tracking distributors, automating payouts, and ensuring transparency across every leg of your organization. In short, if you’re spending more time managing spreadsheets, fixing commission errors, or struggling with real-time visibility, it’s the clearest sign your MLM business has outgrown its CRM and needs a dedicated MLM software solution to scale efficiently and sustainably.

As your network marketing enterprise gains traction, your tools must keep pace. In the early stages, a strong Customer Relationship Management (CRM) system may suffice to manage leads, track distributor outreach and monitor basic pipelines.

But once you start scaling—multiple compensation plans, deep downlines, multiple markets, varied product lines—you’ll run into limitations. That’s when you need a purpose-built MLM Software solution tailored for the specific demands of direct-selling and network-marketing operations.

In this article we’ll explore what signals indicate your business has outgrown a generic CRM, delve into real-time market statistics, and map out the latest industry trends that make specialized MLM software the winning choice.

A CRM excels at tracking customer interactions, sales leads and basic pipeline analytics. But when you introduce multi-tier commissions, binary/matrix/hybrid plans, distributor genealogies, overrides and cross-market uplines, the system of structure becomes more than a “contact + deal” model. According to industry commentary:

“Integrated MLM Software’s CRM … supports downline structures and hierarchy tracking (e.g., binary, matrix, unlevel, hybrid plans).”

When you start manually reconciling genealogies, double-checking overrides or managing spreadsheets to fill the gap, it’s a strong sign your CRM is reaching its stretch limit.

As your network grows, so does the need for live dashboards: active distributors, volume by leg, bonus consumption, rank advancement, churn rates. Generic CRMs often lack built-in modules to report on network metrics, so you resort to Excel exports, delayed data or ad-hoc queries. Meanwhile, specialized MLM systems embed these analytics and visualisations. For example:

“Effective CRM in MLM software … keeps customers satisfied, improves retention rate and gets more done on the sales front.”

Thus, when you’re noticing delays, manual workarounds or blind spots in metrics, it’s time to evaluate transitioning.

In a scaling MLM business you may face: automatic placement of new recruits, validation of KYC, multi-currency payouts, country-specific tax/compliance rules, e-wallets, mobile apps for distributors, product inventory and shipping across regions. Generic CRM tools rarely offer deep built-in support for these operations. Accordingly:

“MLM Software … provides data-driven decision making, mobile app functionalities for distributors and customers.”

If you find yourself layering on plug-ins or building complex integrations just to make your CRM do what an MLM platform handles out-of-the-box, you’re paying in complexity—and risk.

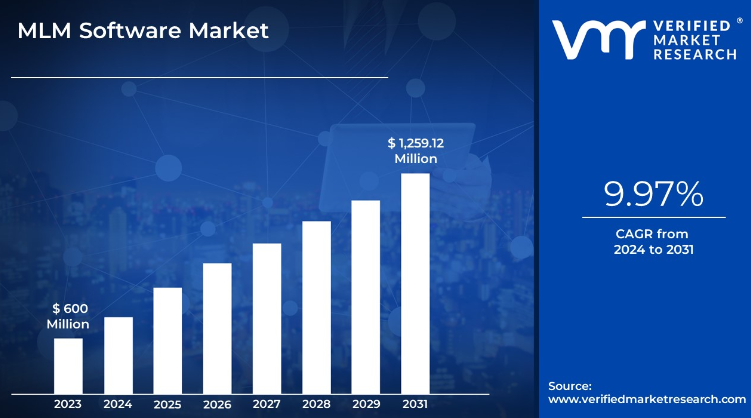

Here’s some market data that underscores the rapid growth and specialised needs of MLM software:

| Metric | Statistic | Mitigation / Best Practices |

|---|---|---|

| Global MLM software market size (2024) | ~$223 million, with projection to ~$344 million by 2030 (CAGR ~7.5%) | Consult legal counsel; implement KYC/AML, licensing, and transparent token economics. |

| Alternate figure | Some sources indicate the MLM software industry may hit USD 2.5 billion by 2031 (CAGR ~9.5%) | Use stablecoins or hedging, reserve buffers, or hybrid value models. |

These figures signal that the demand for specialised solutions is rising—not generic CRMs. The larger the network and geographic spread, the more specialised toolset required.

Here are the red flags to watch for:

If you tick off 3–4 of these, you’re firmly in the zone where a dedicated MLM solution becomes a strategic investment rather than a nice-to-have.

Below are current trends you’ll want in your next system, reflecting what the market demands today:

In short: your next system needs to be purpose-built for the network-marketing model—rather than adapting a sales-CRM to fit.

| Category | Generic CRM Systems (e.g., Salesforce, Zoho) | Dedicated MLM Software (e.g., Prime MLM Software, Exigo, Pro MLM) | Why It Matters for MLM Businesses |

|---|---|---|---|

| Core Focus | Customer & sales relationship management | Distributor network management & compensation automation | MLM is not just “sales” — it’s network growth + payout accuracy + duplication |

| Downline / Genealogy Tracking | ❌ Not supported (manual via spreadsheets or plugins) | ✅ Built-in hierarchical tree view (binary, matrix, unilevel, hybrid, etc.) | Visualizes network structure & automates distributor placement |

| Compensation Plan Management | ❌ Requires complex customization | ✅ Prebuilt & configurable plans (binary, matrix, board, stair-step, hybrid) | Accurate payout automation across levels & markets |

| Commission Calculation | ⚠️ Manual or through third-party add-ons | ✅ Automated, real-time, multi-level payouts | Eliminates commission errors, ensures transparency |

| Multi-Currency & Multi-Language | ⚠️ Limited, requires integrations | ✅ Native support for multi-market MLMs | Essential for international expansion |

| E-Wallet & Payout Integration | ❌ Not available by default | ✅ In-built e-wallet, commission ledger & withdrawal systems | Streamlines financial flows & improves trust |

| Distributor Portal / Mobile App | ⚠️ Customer portals only | ✅ Distributor dashboard, rank tracking, real-time performance analytics | Empowers distributors to self-manage & grow |

| Lead & Prospect Management | ✅ Strong capabilities | ✅ Integrated with recruitment funnels & referral systems | MLM software merges lead management with referral automation |

| Training & Onboarding | ⚠️ Requires third-party LMS | ✅ Built-in e-learning, rank-based training access | Simplifies distributor onboarding & reduces attrition |

| Product & Order Management | ✅ Standard e-commerce features | ✅ Advanced product linking, inventory sync, auto commissions | Connects product purchases to compensation system |

| Team Analytics & KPIs | ⚠️ Generic sales analytics | ✅ Network volume, leg health, churn rate, growth velocity | Enables predictive decision-making for leaders |

| Compliance & Regulation Tools | ⚠️ Basic record-keeping only | ✅ KYC/AML checks, tax reports, audit logs, role-based access | Ensures compliance with local laws & payout transparency |

| Scalability for 10K+ Users | ⚠️ Performance drops, license costs rise steeply | ✅ Optimized for mass distributor networks | Designed to scale without compromising speed or data accuracy |

| AI & Predictive Insights | ✅ Common CRM add-on | ✅ Predictive churn, rank projection, incentive forecasting | Tailored AI insights for MLM growth, not generic sales forecasting |

| Blockchain Integration | ❌ Rare | ✅ Optional for payout transparency (esp. crypto-MLMs) | Builds distributor trust through verifiable transaction trails |

| Social Selling & Referral Links | ⚠️ Basic campaign tracking | ✅ Built-in referral tracking, affiliate links, social auto-posting | Turns distributors into micro-influencers easily |

| Customer Support Automation | ✅ Chat & ticket support integrations | ✅ AI chatbots + distributor support ticket system | Handles both customers and large distributor bases efficiently |

| Pricing Model | Subscription per user (high at scale) | One-time license or tiered plan (volume-based) | MLM platforms are cost-efficient at scale |

| Typical Monthly Cost (100 Users) | $1,000 – $3,000+ | $500 – $1,500 (depending on custom modules) | Better scalability ROI beyond 200+ users |

(Scale: 1 = Weak | 5 = Excellent)

| Feature | CRM Score | MLM Software Score |

|---|---|---|

| Network Management | 1 | 5 |

| Compensation Automation | 1 | 5 |

| Analytics & Reporting | 3 | 5 |

| Compliance & Payout | 2 | 5 |

| Scalability | 3 | 5 |

| International Support | 3 | 5 |

| Cost Efficiency | 3 | 4 |

| CRM & Marketing Automation | 5 | 4 |

✅ Verdict:

If your business revolves around customers, CRM wins.

If your business revolves around people + structure + payouts, dedicated MLM software is the clear winner.

MLM Software Market Size (2024): $223 million → projected $344 million by 2030 (CAGR ~7.5%)

Top Growth Drivers:

Rise of AI-powered distributor analytics

Surge in mobile-first MLM operations

Integration of crypto/blockchain payments

Increasing regulatory oversight demanding compliance automation

Leading Platforms: Prime MLM Software, Exigo MLM, Ventaforce, Pro MLM, MarketPowerPRO

When your network-marketing business begins to strain your CRM system—whether through complex compensation, global expansion, real-time analytics needs or compliance burdens—that’s your sign that you’re ready for purpose-built MLM software. The specialised software market is growing rapidly (CAGR ~7–10 %) and offers features tailor-made for the unique demands of direct-selling organisations.

By recognising the signs early and transitioning strategically, you’ll move from firefighting spreadsheets and workarounds to an integrated, scalable engine that drives growth, empowers your distributors and unlocks new operational efficiency.

What’s the main difference between CRM and MLM software?

CRM manages customers and sales; MLM software manages distributors, genealogy, and multi-level payouts.

How do I know if my MLM business has outgrown a CRM?

When you rely on spreadsheets for commissions or struggle to track downlines, it’s time for MLM software.

Can CRM handle multi-level commissions?

No, traditional CRMs don’t support complex binary or matrix compensation plans natively.

What features make MLM software unique?

Automated payouts, genealogy trees, rank management, e-wallets, and compliance modules.

Is MLM software suitable for small network marketing businesses?

Yes — most modern MLM platforms scale from 100 to 100,000+ distributors.

Can MLM software integrate with existing CRMs?

Many platforms offer API integrations to sync leads, sales, and contact data seamlessly.

What’s the average cost of MLM software in 2025?

Depending on features, monthly plans range from $500–$1,500; enterprise licenses are often one-time payments.

Is MLM software secure and compliant?

Reputable solutions use KYC/AML verification, encrypted data storage, and audit trails.

Which industries benefit most from MLM software?

Health supplements, cosmetics, financial services, and digital memberships benefit greatly.

How does MLM software help boost sales performance?

It provides real-time visibility, incentivizes distributors, and automates training and payouts.

👉 Try the official MLM Software Demo for Your MLM Business

and experience what MLM Software looks like when it’s powered by the best.

💌 Or, check out our blog

to compare top direct-selling companies, get insider reviews, and learn how to grow your income ethically in the wellness niche.